Retirement Planning in Canada

How Much Do You Need to Retire in Canada?

Financial Independence & Early Retirement (FIRE)Traditional Canadian retirement also known as “nine-to-five and retire at age 65” is heavily dependent on Canada Pension Plan (CPP) and Old Age Security (OAS) for a middle-class retirement. Every year you work and contribute to CPP from the age of 18 to, until you retire (age 65), you add to your benefits. I am going to analyze some ‘advanced retirement options’, as CPP and OAS may not be enough for funding your retirement. Prerequisites:

Financial Independence & Early Retirement (FIRE)Traditional Canadian retirement also known as “nine-to-five and retire at age 65” is heavily dependent on Canada Pension Plan (CPP) and Old Age Security (OAS) for a middle-class retirement. Every year you work and contribute to CPP from the age of 18 to, until you retire (age 65), you add to your benefits. I am going to analyze some ‘advanced retirement options’, as CPP and OAS may not be enough for funding your retirement. Prerequisites:

You are a Canadian citizen

You are a ‘couple’: but if single your mileage may vary, as far as calculations here go

Most important aspect for retirement planning is that you go into retirement with no debt like mortgage, consumer debts and continue to live a modest lifestyle.

To go any further from here, you must have tracked your annual expenses. If you have never tracked your expenses, and consider yourself as a ‘average Joe’, it’s safe to assume an annual income of $50,000 is sufficient for post-retirement living. This amount of $50,000 might sound a little, but if your mortgage is serviced and you are debt free this number represents a comfortable lifestyle.

Contemporary financial advisory is to save enough to replace 70% or more of your gross income during working years.

However, if you don’t like this number of $50K per year, another popular retirement number of $1M nest egg to retire comfortably.

If you are a hard-core type investor and want to calculate this number yourself, follow this tutorial: How to calculate your Financial Freedom Number?

Expenses during Retirement include: • Mortgage payments

• Reduced income tax

• Saving for retirement

• Childcare expenses (hopefully)

• Work clothes, lunches, commuting costs

• CPP and EI contributions for this example we will set our annual expenses to $54,000 per year.

Post Retirement Payments to Retirees Payment 1 – CPP 15,200 per year per couple You can start receiving benefits of this program as early as age 60 with penalties. You will have a larger CPP payout after age 65 and up to age 70. The maximum payout for a person aged 65 in 2018 can receive is $1,134.17 per month. However, the average is $643.92/month.

Post Retirement Payments to Retirees Payment 1 – CPP 15,200 per year per couple You can start receiving benefits of this program as early as age 60 with penalties. You will have a larger CPP payout after age 65 and up to age 70. The maximum payout for a person aged 65 in 2018 can receive is $1,134.17 per month. However, the average is $643.92/month.

A Canadian couple who has worked in Canada all their lives could receive about $15,400 annually from CPP. From January 1, 2018, the maximum CPP retirement benefit for a new recipient age 65 will be $1,134.17 per month ($13,610.04 yearly). However, the average payout is about $500 per month ($6000 yearly). Call Service Canada 1-800-277-9914 or go online at www.canada.ca and ask for a ‘CPP Statement of Contributions’. CPP statement of contributions (SOC) list all the eligible years to contribute from age 18 to 65, how much you contributed in each of those years.

If you contributed the maximum, letter ‘M” assigned for that year. Add up all the M’s, if you have 40 M’s you’ll get the maximum. On the other hand, if you have 20 M’s your CPP benefits would be about half the maximum. To receive full (maximum) CPP benefit do the following:

How to receive 100% CPP benefit for retirement by (old 40)39-point system:

Numbers of years contribution: The first criteria is you must contribute into CPP for a minimum of 39 years. Keep on contributing for at least 83% (earlier it was 85%) of the time that you are eligible to contribute. Eligibility to contribute is from the age of 18 to 65 (total 47 years). Therefore, 83% of 47 years is 39 years. If you did not contribute into CPP for at least 39 years, then you won’t get the maximum. Also, there is another consideration, ‘the amount you contributed’ during your working life.

Amount you contributed: Yearly Maximum Pensionable Earnings (YMPE) under the Canada Pension Plan for 2018 is $55,900 ($55,300 in 2017), as a result, the maximum employee CPP contribution for 2018 will increase to $2,593.80. YMPE means if you make more than YMPE in 2018 ($55,900), you will only contribute on first of $55,900 to CPP, it also means less than YMPE will not get you enough contribution for full pension.

Payment 2 – OAS 13,200 per year per couple As of July 2018, Old Age Security Pension (OAS) the basic amount is $596.67 per month. This government benefit is taxable income and is subject to a recovery tax (see note below). Eligibility to receive a full pension is that you should have lived in Canada for at least 40 years after age 18. If you left Canada to live elsewhere, or you haven’t resided in Canada for the full 40 years, OAS is calculated at 2.5% (1/40th) of the full OAS pension for each complete year of residence in Canada after age 18. OAS is indexed for inflation every January, April, July and October. According to the OAS website, here are the qualifications:

- Age 65 or older

- Canadian citizen or legal resident on the day before application is approved

- have been a Canadian citizen or a legal resident of Canada on the day before you left Canada, if you no longer live in Canada

- have lived in Canada for at least 10 years since your 18th birthday to receive OAS in Canada and

- have lived in Canada for at least 20 years since your 18th birthday to receive OAS outside of Canada. 2017, providing that you’ve lived in Canada for at least 40 years since age 18, a retiree aged 65 will receive $583.74 per month or $7000 per year or $1400 per couple per year.

Note: If your retirement income is greater than $123,302 (latest OAS info), it may result in the OAS claw-back. OAS maxes out at $550 per retiree per month or $13,200 per couple per year. Combining the two brings a couple over $28,400 a year. If your net income is less than $17600 for single pensioner or $32,700 per couple during retirement, then you may qualify for the guaranteed income supplement.CPP payment: $15,200(add) OAS payment: $13,200Total per couple: $28,400 (minus) Total expenses: $54,000Shortfall: ($25,600) Many financial advisers agree that average family require between 50-60% of their pre-retirement gross income to live comfortably during their golden years. This retiree needs to generate $28,400 per year. Using the 4% portfolio withdrawal rate rule, “safe” for a portfolio to last 30 years, simply divide the $25,600 (amount needed per year) by 4% or multiply your number by 25. A “Nest Egg” of $25,600*25 (or 25,600/.004) =$640,000 in savings should do the trick. Without a company pension, this is about 64% of one million, that some financial planners recommend. With many middle-class couples with no debt able to retire on approximately $50k/yr in today’s dollars. But our example $54,000 per year, leaves a gap of $25600/yr to be funded by company pensions and or savings (RRSP, TFSAs etc).

Alternative sources to Fund shortfalls for post-retirement:

Alternative sources to Fund shortfalls for post-retirement:

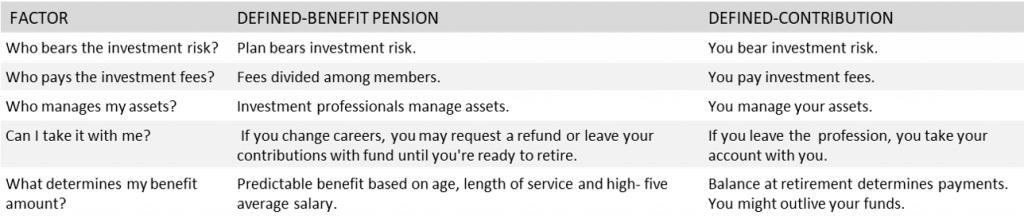

3. Work pensions Defined Benefit Pensions (DBP):

Also called gold-plated pensions where employer make a fixed contribution to the plan based on their income, but get a generous retirement benefit regardless of market performance. A typical Defined Benefit Plan will offer 60%-70% of the employees’ average salary over the last several years of service once they reach the 30 to 35 years of service mark. So, for example, someone with DBP in his/her early mid 50’s, will have accumulated over 30 years of service at which point they’ll be entitled to around a pension of around 66% of their working pay. If he/ she reaches the 35 years of service milestone, they will receive around 70% of their working pay during retirement. Note that many pensions incorporate CPP into their calculations, so if you are part of a DBP, you’ll need to read into the details. The payout, at the time of collection, is fixed to a formula= (combination of years of service) multiplied by a (%age of average salary over the last several years of service).

The Advantages: Retirement income is relatively high (up to 70%), independent of market performance and usually adjusted for inflation. Also, ‘higher income years prior’ to retirement really works to the employee’s advantage.

The Downsides: Expensive on the employer, biggest risk with having a non-government DBP not being funded properly. Some DBP’s only allow a portion of the pension to be transferred to a spouse if the beneficiary passes away, whereas an RRSP is more flexible where all assets can be transferred.

4. Work Pensions-Defined Contribution Plan (DCP):

The pension in this case is very similar to an RRSP where you can pick your investments (how to choose mutual funds within your work pension). In this arrangement, the employer has de-risked itself as they do not provide any guaranteed income in retirement. Basically, the employee lets the account grow over the years, and withdraws from the account to support expenses during retirement. Most companies (and now even some government entities) offer defined contribution plans. (More standard than, DBP). Common work place setup, employee and employer jointly contribute to a plan, but the retirement benefits depend on market performance over the years. The employer has de-risked itself as they do not provide any guaranteed income in retirement.

Basically, the employee lets the account grow over the years, and withdraws from the account to support expenses during retirement. This type of pension is becoming more standard with employers as it essentially takes the risk and extra cost away from the employer (and the employee if the company goes bankrupt)

Post retirement options with DCP:

1. Leave the account with the pension company: Let them switch it to one of their internal portfolios – they can keep the funds within their portfolios and charge MER. If it is more than 2%, MER is way too much for portfolio management. Even with the most expensive mutual fund providers, you can usually pick their indexed mutual fund products in the 1% range. Even 1% is not low enough. Reducing your MER from 2% to a simple ETF portfolio with a MER of 0.30% can result in a 60% difference in portfolio size over 30 years. If you had the choice, would you pick $1M over $600k?2. Transfer the assets into our own LIRA: If managed by Financial Institution then assets are already self-directed, Investor has second choice to transferred the money from FI to a Locked-In Registered Account (LIRA), It is an RRSP that allow assets to grow tax-free, but you have to wait until a certain age before you can withdraw from the account.

The minimum withdrawal age depends on the province where the LIRA is registered, for NL, it’s 55 (here’s a resource for other provinces). There are other special circumstances that allow access to a LIRA including financial hardship, spousal support, a life-threatening health issue, or becoming a non-resident of Canada.

Not all employer DCP’s require that you transfer into a LIRA. Some will allow you to transfer to an existing RRSP – the best bet is to contact your provider for more details.

Advantages: portfolio grow, Control over your money and investments within the plan.

The Downside: Retirement income is entirely market dependent, must understand finances need to be involved with the portfolio. 5. Your Own Savings – Registered Accounts (RRSP/RRIF/LIRA/TFSA): RRSP: Contributions to an RRSP are tax-deductible but withdrawals are counted as taxable income. The goal is to contribute to an RRSP during high earning years, let investments grow tax-free for the long term, then withdraw during lower-income years.

5. Your Own Savings – Registered Accounts (RRSP/RRIF/LIRA/TFSA): RRSP: Contributions to an RRSP are tax-deductible but withdrawals are counted as taxable income. The goal is to contribute to an RRSP during high earning years, let investments grow tax-free for the long term, then withdraw during lower-income years.

There is no minimum age for opening an RRSP, but in the year you turn 71, you must stop making contributions and convert the account into either an annuity or a so-called Registered Retirement Income Fund (RRIF), which requires that you make minimum withdrawals every year. With an RRSP, the government doesn’t tax you on the money you put it. That’s why you generally get a tax refund when you make a lump-sum deposit into an RRSP

TFSA: TSFA is a backward RRSP where contributions are made with after-tax dollars (i.e. no tax deduction), investments grow tax-free, but withdrawals are not taxable. The added benefit of TFSA withdrawals is that it doesn’t count towards OAS claw-back limits. With a TFSA, you make deposits with after-tax dollars – so no tax refund. You need to be 18 to open an account, but there’s no upper age limit for making deposits – and you don’t have to take money out if you don’t want to.

LIRA: Locked-In Registered Account (LIRA) is an RRSP that is locked in until a certain age (depends on the province) and usually results from transferring a work DCP into an account that you control. Process of Transferring a Pension to a LIRA:

1. Setup a LIRA – Before choosing to transfer assets to a LIRA, set up a LIRA with any major discount brokerages. The process is easy and almost everything online (except one beneficiary form to be mailed in).

2. Send Pension Company the Transfer Form – Once the LIRA is opened (might take one week a week), Fill information required in the transfer from provided by FI (like GWO). In addition to the transfer instructions, include an “Addendum for Locked-In Retirement Accounts” provided by discount broker.

3. After sending the transfer instructions to the Financial Institution, funds might take to appear in the new LIRA about 7 business days.

6. Your Own Savings – Non-Registered Accounts/Savings:

If you have maxed out your registered (tax-sheltered) accounts, and still have the cash to invest, then it may be time to look into non-registered accounts. While the investments in these accounts are taxable (dividends and capital gains), they get better tax treatment than RRSP withdrawals. (i.e. general income). Build a dividend portfolio with a non-registered account, you can make up to $50,000 in dividends without paying any income tax, providing that there is no other income. This makes a pretty attractive concept for someone considering early retirement.

7. Insurance Annuities:

For non-pension camp, you can build your own defined benefit pension by purchasing an annuity from an insurance company. They work the same way, you purchase an annuity and it pays you a monthly benefit until you pass away. The catch is that the insurance company keeps the initial capital. Generally, when lower interest rate period, the annuity payouts will generally be lower. If you are risk averse, don’t mind fixed income, and you have the savings, you can purchase the income “gap” between government benefits and retirement lifestyle. Annuity payments consist of both principal and interest. Interest is taxable but deferred, spread over the life of the annuity. While your other sources of income (GIC’s, stocks, mutual funds) may eventually be depleted, you cannot outlive your annuity income. Life annuities pay a lifetime of income.

Types of Annuities:

- Term Certain: Fixed payment for a fixed period. If annuitant dies during the guarantee period the beneficiaries(s) receive the income payments.

- Life Annuities: offer guaranteed regular income for the rest of your life. The annuitant will not run out of money but if he/she dies early, there is no refund.

- Joint Life Annuities: It is purchased on 2 lives, issued with or without a guarantee period. They may be sold as Reducing or Non-Reducing annuities. At the first death (or death of the primary annuitant), the surviving annuitant receives a reduced periodic income. If the Reducing Annuity has a guarantee period, the reduction in periodic income would occur after both events have occurred (the death of one of the annuitants and the expiration of the guarantee period). The terms of the guarantee period are usually based on the age of the youngest annuitant.

- Variable Annuity: payment can vary because the interest piece is based on the stock market. However most do offer a minimum rate of interest for every year that the annuity remains untouched. This annuity is like Manulife Income Plus. In a bear market this does not look so bad. However, in a bull market this is expensive. A variable annuity should be bought and thought of as a pension purchased for the long term. Therefore, if the purchaser is seeking immediate income payout, it is best to avoid variable annuities.

- Non-prescribed Annuity: taxes payable on the income earned are higher in the early years of payments but gradually decrease to zero over time.

- Prescribed Annuity: the taxes payable on the income earned are paid evenly throughout the term of the contract.

8 Part-Time Work- Find work that you enjoy:

Part-time work and/or starting a side business. Benefits extra income & getting out, socializing and having a sense of purpose are real tangible benefits of being in work force.

Achieving Retirement Goals

Achieving Retirement Goals