I want FIRE– Financial Independence and Retire Early! I want to trade for a living. I have been trading for ten years, but I started trading professionally only five years ago with coaching from Dan Kaufman (creator of Think or Swim platform), Scott Philips and Online Trading Academy. After these five years I made some meager profits, but I did not lose money. This makes me confident and keeps me pushing to go further and do better.

I like researching and running scenarios for defined outcomes. I understand that trading is a lonely game, that is why I want to reach out to many like-minded traders and take advantage of collective mindfulness!

Trading and investment are a “zero sum game “, because when in the market “professionals” make money. There are “amateurs who lose” money on the other side of the trade. This is also known as smart money and dumb money (what amateurs lose). So, it is about time for you to decide, “What kind of trader you want to be?” My guess is, you want to be a professional trader. But who is a professional trader anyway?

- A person formally certified by virtue of having completed a required course of studies.

- A person with 360-degree knowledge, who spent months and years studying and practicing trading.

- Follows a code of conduct, rules plans and methods about his professional trading.

- Member of some trading community.

- A person who has achieved an acclaimed level of proficiency in his or her calling (trading).

Here is the gist of my personal mission statement, “Trade mechanically with brain, live emotionally with heart“. If you feel, I am also speaking for you, welcome abord!

Trading Plan to Meet Your Goals

Mission is a timeless statement telling “Reason for Existence” and vision is usually for 5 Years, shows a “picture Of a Successful Future”. Here is the gist of my personal mission statement, “Trade mechanically with brain, live emotionally with heart”. If you feel, I am also speaking for you, welcome abord!

My Personal ‘Mission Statement’

To ‘trade professionally’ in all asset classes for a living. Be profitable by selecting ‘low risk’ and ‘high probability’ trades while managing the risks.

My personal mission statement, what is yours? Not decided, yet? You can borrow mine.

With this mission in mind, I am building a trading system by piggybacking on OTA core strategy so that trading is mechanical.

WHY do I trade?

- FIRE Financial Independence and Retire Early!

- Trade for living.

- Helping my favorite charity (Hospice Society)

- Type any other purpose here or delete this line…

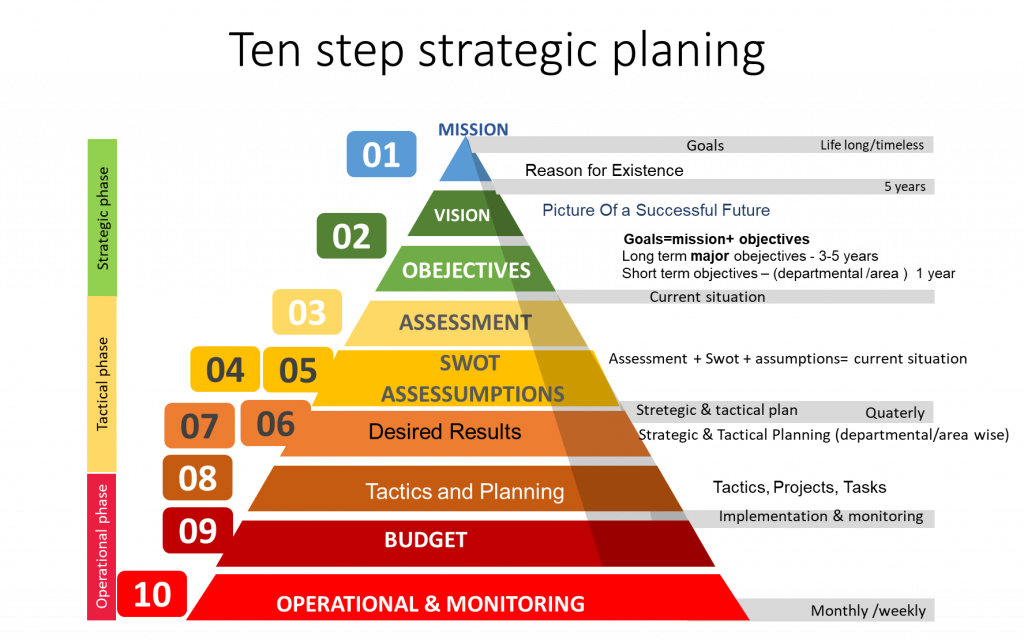

A background in business analysis helped me to outline a trading plan derived from a generic business plan. It is a detailed ten step process to build a trading plan with four broader areas: ‘Goals’, ‘current situation’, ‘Stategic & tactical plan’ and lastly ‘implementation and monitoring’. A goal is a mission and vision statement with objectives, it is almost permanent with the exception of longer-term objectives will have periodic changes to them. Each trade plan essentially consists of the following recurring steps:

| Before the Trade |

| 1. CORE STRATEGY: for idea generation 2. STRATEGY SELECTION: filtration process 3. SETUP: MANAGEMENT -‘TRADE PARAMETERS SELECTION’ (Risk management and psychology. for options trading it is a strike selection) 4. STRATEGY CONFIRMATION 5. REWARD/RISK GRAPH 6. POSITION SIZE 7. EXECUTION– Pull the trigger and place the order! |

| During the Trade |

| 8. MANAGE TRADE 9. MONITOR REPORTS |

| After the Trade |

| 10. LOG TRADE |

- Assessment: Understanding the Underlying asset, Strategy, Techniques and Procedures.

- Let’s jump right into understanding the underlying security.

WHO am I as a trader?

This is a personal SWOT analysis that provides insights in pursuit of my trading goals. These insights are based on my personality’s strengths and weaknesses, what challenges I see ahead of me, and what opportunities are present around me, now and in the future. I have to be fair and honest to write my own SWOT.

My Strengths are:

- I am a logical thinker.

- I have an analytical mind.

- I like planning.

- I like trading, Economics and trending futurist ideas.

My Weaknesses are:

- I have analysis paralysis.

- I procrastinate.

- When I find some idea difficult to understand, I try to make shortcuts without fully understanding.

- Sometimes, I lose track of what is important is what is not. (Prioritization problem).

- This is place holder for any weakness I come across in or I will delete this line in future!

WHICH markets do I trade?

What (Asset classes) Markets will I trade? I want to be truly diversified in my trading activity; therefore, I’ll be trading:

My focus will remain on the Equity markets, Futures, Forex, Options and Indices but I will look to Cryptos markets and duplicate successes in Crypto currencies market arenas when my time, training and comfort level allows for greater trade frequency.

I have been ignoring cryptos for so long, because they are very volatile and bit coins are created out of thin air (my Economics background is big stumbling block to trade cryptos)

(Lists of my asset classes) I recently added Crypto Currencies.

HOW MUCH money do I make?

Parameters of Income (money needed for day-to-day needs) and Wealth (money needed after retirement in future):

My Income Goals are:

- __% of my account per trade. or $_______ per trade.

- __% of my account per Choose an item. or $_______ per Choose an item. Choose an item.

- __% of my account per Choose an item. or $_______ per Choose an item. Choose an item.

My Wealth Goals are:

- __% of my account per Choose an item. or $_______ per Choose an item. Choose an item.

- __% of my account per Choose an item. or $_______ per Choose an item. Choose an item.

- __% of my account per Choose an item. or $_______ per Choose an item. Choose an item.

- Type any other goal here or delete this line…

My Accounts are:

- Day trading account with $47,000

- Registered Retirement account with $150,000

- Registered Tax-Free Savings Account with $80,000

- Mutual Fund in my Universal Insurance with $27,000

WHEN do I trade?

Time Allocation for Income:

- I will devote 2 hours per day from 5:30 am to 6:15 am and 5pm to 6 pm daily.

Time Allocation for Wealth:

- I will devote 1 hour per week on weekends to trade and research my wealth accounts.

HOW do I trade?

Parameters of trading methods:

I apply Core Strategy to find low risk, high reward, high probability opportunities while I manage my risk and my emotions following a rule-based plan that I follow with impeccable discipline.

Risk Management Rules

- I cut my losses short and I let my profits run:

- I never open a position in the market without knowing my initial risk

- I define my profit and loss as some multiple of my initial risk

- I limit my losses to 1:1 or less

- I always use Stop Orders

- I only take opportunities with Risk vs. Reward Ratio equal or bigger than choose an item. to 1st Target

- I never risk more than 2% of the account I am using to trade for any particular trade

- When trading multiple positions at the same time I never have more than 5% of my account at risk at the same time.

- Other risk management rules for the future!

Account customization parameters:

| Cryptos | Stocks/Options | Futures | Forex | |

| Account Size | $100,000 | $20,000 | $10,000 | |

| Maximum Risk per trade | $1,000 | $200 | $100 | |

| Maximum Daily loss | $3,000 | $600 | $300 | |

| Maximum Weekly loss | $5,000 | $1,000 | $500 | |

| Maximum Monthly loss | $10,000 | $2,000 | $1,000 | |

| Maximum opened trades per day | 2 | 5 | 3 | |

| Maximum opened trades per week | 8 | 20 | 12 | |

| Maximum opened trades per month | 20 | 50 | 30 | |

| Allowed to hold trades over the weekend | Yes | No | Yes |

Core Strategy Rules

I am a technical trader; therefore, to me… a chart is a chart!

My main focus is to define where the institutional Supply and Demand is to base my trades on this simple concept. Trading is a probability game; therefore, my methodology is based on finding situations where the odds are in my favor. I only go long when price is at Demand and I only go short when price is at Supply.

Timeframes to be used:

Daily setups (only) during my initial trading phase.

What Setups will I trade:

I will scan for the following two “trend” setups:

1) Basing/Breakout near 20ma,

2) Pullback to Minor Support or a rising 20ma.

| Trading Purpose | Chart Time Frames | |||

| Curve “HTF” | Trend “ITF” | Levels “LTF” | Refining “RTF” | |

| Hourly Income | 60 min | 15 min | 5 min | 1 min |

| Daily Income | Daily | 60 min | 15 min | 5 min |

| Weekly Income | Weekly | Daily | 240 min | 15 min |

| Monthly Income | Monthly | Weekly | Daily | 60 min |

- Higher Time Frame (HTF) – Used to identify the Supply Demand Curve

- Intermediate Time Frame (ITF) – Used to identify Trend Direction

- Lower Time Frame (LTF) – Used to identify fresh Supply and Demand levels

- Refining Time Frame (RTF) – Used to fine-tune the location of proximal and distal lines to either not miss the trade or to minimize risk

Charts Setup:

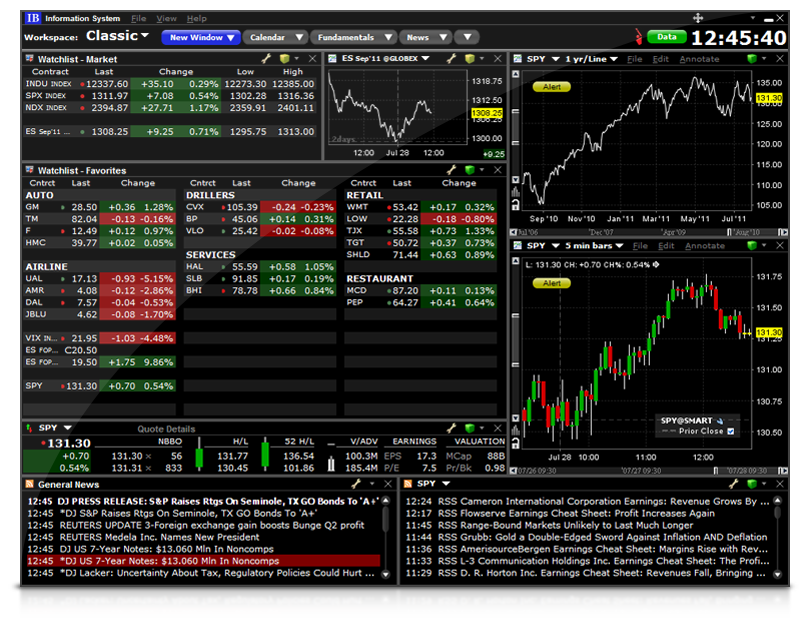

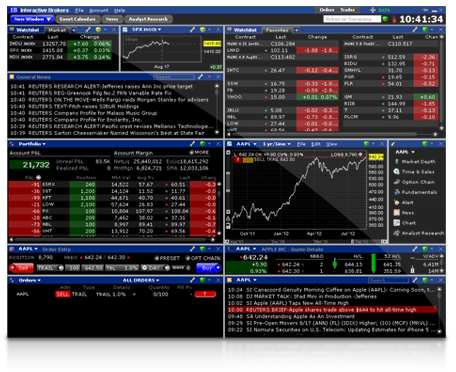

I will have 3 charts on two monitors as follows:

I am pasting screenshot of my trading environment:

3. |

2. |

| 1. |

| Supply and Demand |

| Trend Analysis |

| Curve Analysis |

Steps to follow:

- On the HTF Chart identify the Supply/Demand Curve

- On the ITF Chart identify the Trend

- Once Curve and Trend are identified, check the following table…

- When the right action is to Sell, use the LTF to identify high quality Supply Zones. When the right action is to Buy, use the LTF to identify Demand Zones

- Refining using the RTF Chart is optional

- Supply and Demand Zones to be used for Entry need to score at least 80% on the Odds Enhancers

Entries, Exits, and Trade Management:

Entry rules:

All orders will be “Limit Orders” at the “Ask price” once a trade confirmation has been achieved. If my full share lot was not executed, I will seek to add liquidity by buying the remaining shares at the currently displayed bid price.

Where will I place my Stops:

My stop-loss prices will always be determined prior to entry, and will be at logical major-pivot locations on the chart that I’m trading from.

Exit take profit (and/or) trail-stop rules:

Half profit will be taken nearing a predetermined point of support/resistance, which must represent a 2:1 reward/risk ratio. Final profits will be taken after confirmation of the end of the current trend (from chart of entry), unless ultimate target has been achieved first.

Risk Management rules:

My trade risk (1R) will be 1% of current (daily adjusted) trading capital. I will not have more than 4R at risk at any one time.

- For Income Trades, I place an alert just before Entry, and if upon Arrival the setup still offers the minimum R: R and Odds Enhancers Score then I place the order

- For Wealth Trades, I place the orders as well as an alert just before Entry so I’m notified when price returns to the Zone

Stops

As a general rule the Stop Loss Order should be placed at a price where if triggered it would mean the setup was objectively wrong. Stops should not be placed at a price where I would consider entering a trade, because in that case price may hit the Stop Loss Order and reverse back soon after. The Stop Loss Order is placed beyond the Distal Line by some wiggle room calculated as follows:

- Income Trades: Add 2% of the Daily ATR (round up)

- Wealth Trades: Add 10% of the Daily ATR (round up)

Targets

- Income Trades: I will place the Target just before the first opposing Choose an item. level

- Wealth Trades: I will place the Target just before the first opposing Choose an item. level

Trade Management

Once I am in a trade and the Market starts moving my way, I am ready to start moving my Stop Loss Order to lock in some profits…

- I move my Stop to Break Even once the trade has moved Choose an item. on my favor

- I keep moving my Stop towards locking more profits every time a new Supply (for Shorts) or Demand (for Longs) Zone forms in the Choose an item. after Entry

EMERGENCY NUMBERS

Contact parameters related Interactive Brokers and Trading Accounts:

1 (877) 745-4222 Toll free

1 (514) 847-3499 Direct dial

Menu Options:

1 Trade Related Issues

1/1 Phone Orders

1/2 Trade Issues

1/3 How to use TWS

1/4 Margin Issues

Your Trade Checklist

Minimize Losing Trades Step by Step

#1 The setup meets all my entry criteria

#2 The trade is in my trading plan

#3 The trade is in the direction of the trend

#4 No news announcements ahead

#5 The risk/ reward is acceptable

#6 I feel good emotionally and physically

#7 I accept to lose

Pre-market activities and routine:

Log in to trading platform. Review index charts for short-term bias. Use my chosen finance website to review earnings reports, and then log into the Trade Ideas scanner for new trade opportunities. Load potential trades into long and short watch lists. Set alerts near entry points.

Post-market activities and routine:

Update Journal. Take screenshots of closed trades and hyperlink to its corresponding trade journal entry. Review all open trades for possible next day action.

Review any closed trades to determine whether plan was followed (or not). Mark up SPY and Q’s chart for next day bias. Clean-up trading platform.

Tools will I use for my trading business:

- Trading computer

- Trading View Pro – charting platform

- Yahoo Finance, Trade Ideas – scanning software and opportunities

- Dashboard for trade Analysis and Record-keeping

Review process:

Review the notes and screenshots of each trade 5-8 days after closure and after all biases and emotions have subsided. Write notes in the journal sections of the TJS as to how future trade executions, management and exits can be improved. Bi-weekly,

Discipline & Mindset notes:

I will abide by the (5) Fundamental Truths & “Trader” Mindset, from author Mark Douglas of “Trading in the Zone”.

- “Anything” can happen

- I don’t need to know what is going to happen next in order to make money.

- There is a random distribution between wins & losses for any given variable that defines an edge.

- An Edge is nothing more than an indication of a higher probability of one thing happening over another.

- Every moment in the market is unique.

My Golden Rules (Trading Commandments:)

- Be disciplined every day, and in every trade.

- I will be my own trading “self”, never trading another’s plan.

- I love taking small losses.

- I’ll always earn the right to trade bigger.

- I am not addicted to trading just to see what happens.

- I only trade high reward setups that have the probabilities in their favor.

- Be a bricklayer – make the same type of trades over and over again.

- Once I find a setup, I do not hesitate; once in a trade, I do not over analyze.

- A detailed Trading Journal will be kept at all times, and I will act upon what it tells me.

- Everything I do will be for the success of my business!

Leave a Reply