How do you determine what is the minimum acceptable earnings by day trading? What is the appropriate earnings target? Is it 50% , $2500 (per month), $50,000 per year or equal to or greater than Dow Jones or S&P’s annual return? Should your returns be based on benchmarks set by the biggest investors?

Unrealistic Return target: I want to earn 50% on my $1000 account per month!

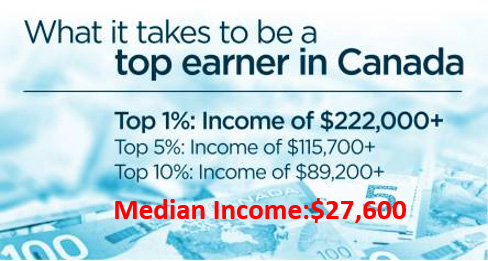

So, how on earth did I reach to that conclusion! Well, look at the ‘median annual income’ per Canadian is $27,600.

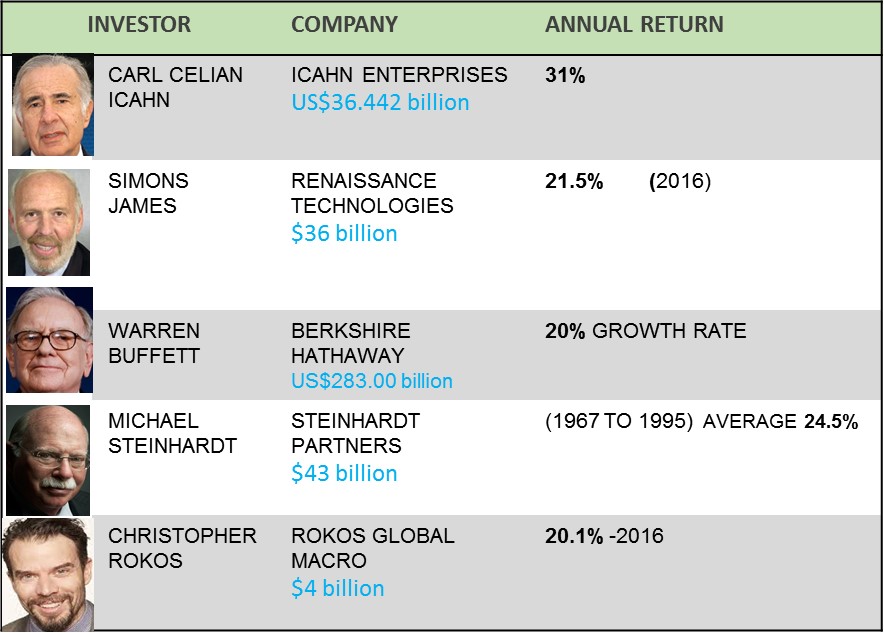

And how industry’s top investors are faring in this game.

What if you are day trading or swing trading for income, then your game plan different. Get real do the math:

if I do 20 trades per month out of which 12 winners and 5 losers and 1 cancelled trades. Now my win percentage is (12/20)*100 = or 60%. (if cancelled trade is accounted then 12/19 x 100=63%). On my losses on 5 losing trades were $1500, and average loss is $1500/5 = $300. Those 12 winning trades made me a profit of $6,000, then; My average win=$6,000/12 = $500.

Let’s try again and answer the question, “how much money can I make from Forex trading?”

Answer depends on the following numbers:

- Trading expectancy : Your expected return on every dollar you risk for trade.

- Expectancy= (1+ Win/Loss) x P – 1 = 1+500/300 x 0.60 -1=1.60-1=60% (Win is average win and loss is average loss size in dollars and P is winning percentage, which is positive 60%, in another words every 1 dollar I trade, I can expect 60 cents return)

- Trading frequency: Number of trades I take is 20 per month or 140 trade per year.

- Account size: Dollar size of my capital account, here it is CAD 50,000.

- Risk amount: My maximum ‘per trade’ dollar amount is 1% of capital (1% of 50K is $500). Some traders also call it bet size.

- Withdrawals: If it is your income account you may be withdrawing some percentage periodically.

Let me populate the formula to get yearly returns:

Trading expectancy * Trade Frequency * Risk Amount per trade = 0.60 * 140 * $500 = $42,000 (annually)

[Trading expectancy * Trade frequency * Risk amount]($42,000) / Account size($50,000) =$42,000/$50,000= 84%, This means expected average of 84% in a year year.

Realistic earning: target of 5% per month on $50,000 account size, would get me $2500 per month or $30,000 annually. Most important number is your account dollar size.

Leave a Reply