Applying Agile in Trading: How to Adapt to a Dynamic Market

By J Mahay |Apr. 5th, 2023

In the ever-evolving world of trading, embracing strategic planning, and applying agile methodologies to trading business can change how you trade forever.

Agile methodology is a popular approach to project management that emphasizes flexibility, collaboration, and iterative development. While it is commonly used in software development, it can also be applied to trading to help traders adapt to the dynamic and ever-changing market environment. The Blend of technology and human insight can lead to remarkable success in the dynamics of trading various markets.

Agile Trading Portfolio Management

I am going to implement Agile methodology in my trading. Agile trading portfolio management applies the principles of agile development to managing a portfolio, division of labor, process design, and project management tools. I don’t have a team, therefore I assume all responsibilities. In big investment firms Agile Portfolio Management’s investment team assume roles of agile teams. Here is very brief description of Agile software development team (in brackets Agile portfolio management team) is described:

Product Manager (Portfolio Manager) : responsible for the composition and performance of the investment portfolio. Accordingly, they are in charge of assessing the portfolio in light of evolving market conditions, identifying risks or areas for improvement, and setting the research agenda. Portfolio managers are primarily, although not exclusively, responsible for generating new ideas.

Scrum Master (Research Manager) : day-to-day research process, investment checklists, valuation models, and Kanban-style lists, and ensuring the overall quality of the research product.

Development Team (Research Team): team conducts the front-line investment analysis and is responsible for aggregating and communicating research findings with the entire investment team.

The investment and trading process is organized around the agile concept of weekly sprints to discuss portfolio maintenance, current and new opportunities continually flow through the backlog (watchlist of trading opportunities. My trading day starts with the ‘Scrum’ routine that encourages disciplined, and reflective trading. Reviewing my strategies to minimize losing trades, and working on profit making strategies in most important. I am going to be flexible to adapt changes, regular self-evaluation and consistent performance that professional trader needed.

- an agile process closely resembles the workflow of a well-functioning investment process

- Agile development is organized around short cycles of work called sprints that can last anywhere from one to four weeks. Sprints are constructed around user stories and designed to address a specific customer pain point.

- Brief daily meetings, called “scrums”, during the sprint allow the team to share progress, identify obstacles, and prioritize next steps.

- Look into your insights to see when your audience is active on Instagram

- Always be clear on what your CTA is

The capital markets teams collaborate and make decisions in the middle of uncertainty to deliver a ‘financial product’ or a trade or position. Process of developing a software application and the process of managing an investment portfolio are similar conceptually. A portfolio manager and his/her team to analyze the opportunities continuously presented by the markets and make decisions to seek trade opportunities to select assets classes in the portfolio (product) requires to delight his end users (investors). In my case I am both end user and portfolio manager, an one man team!

Portfolio Investment Process Design

It’s important to note Agile methodology here is not about “the trading strategy” for reading , trading the market or devising a trading plan. This is about changing routine.

Jas Mahay

At vero eos et accusamus et iusto odio dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati cupiditate non provident, similique sunt in culpa qui officia deserunt mollitia animi, id est laborum et dolorum fuga.

Portfolio Investment Process Design

- Remain Top of Mind

- Be Seen to Sell

- Learn Something New

Agile Trading Portfolio Management follows the six steps of an agile process with the weekly sprint to go through the equity, indices, currencies, commodities and future trade opportunities research process. The portfolio manager (that is me!) determines the research priorities, and one day a week (mostly Sunday evening) the research manager (again me!) studies research work for the next week, and follow-up research on existing positions or potential new investments. The research team(me!) meets briefly each day to discuss time-sensitive issues, share updates on progress, and manage process constraints. At the end of the sprint, the team meets to review the work and suggest improvements to the process

1. Plan:

Portfolio Requirements: A prioritized list of tasks ( I call ‘backlog’) to complete for the duration of a sprint cycle. This is a key opportunity to filter potential trade opportunities for the coming sprint/week. At the end of every week, the portfolio manager meet to review the portfolio, identify risks and opportunities among the current holdings, and discuss research priorities.

Two outcomes products of the sprint planning:

- List of potential positions that you might open based on my trading strategy. I will not open all of these but the purpose is to plan in advance so that my daily technical and fundamental analysis is directed towards the potential positions, ensuring I don’t over trade in too many markets.

- The second product of this session is my burndown chart for the sprint. The Scrum terms the burndown shows work left to do as a function of time.

2.Design: Sprint Design

Once the portfolio requirements and research priorities have been set, team review the current idea backlog for new ideas and the weekly quantitative screens to find new ideas to meet the identified portfolio needs. Each week, we select 5-10 new stocks to be included in the sprint. Few, if any, will make it through all of the steps of the research process and be considered for inclusion in the portfolio. This means that over the course of a year 300-500 stocks will pass through our investment process, and we may ultimately invest in just the top few percent of ideas.

Daily stand up:

Teams use these to share what tasks each member completed the previous day, what they’re working on today and any impediments. Although Scrum dictates that these are team meetings I happily stand up in front of my board and have this discussion aloud, reassuring myself this isn’t the first sign of madness. This is best conducted after you’ve done your morning market analysis as this is probably when you’ve decide what trades you will make that day. This is a daily opportunity to review progress to goal and adjust your daily targets where necessary.

Understanding the blockers to achieving the day’s target is an important part of being holistically aware of your trading. These blockers may be external in the form of market uncertainties, big announcements, and unclear technical analysis or they may be internal: your schedule today might not allow you to make as many trades as you need or maybe you’re not feeling ‘in the zone’. Impediments can be a symptom of looming risk so systematically increasing your awareness of potential blockers better equips you to respond and adapt before problems occur.

Just because this is called a Daily Stand Up, don’t be fooled into thinking that this only works for day traders – all the tools discussed here work on most timescales. For example, if you’re a swing trader leaving trades open for various periods, the cards on your Scrum Board remain ‘In Progress’ for longer. This doesn’t detract from the usefulness of Scrum, which forces you to constantly evaluate your trades and strategy to make sure you’re always on top of your game.

3. Develop: Thesis Development (Level 1 Research)

The first phase of the fundamental research process involves evaluating the stock’s fit across the four metrics that we most highly value – Fundamentals, Management Quality, Valuation, and Catalyst – to develop an investment thesis that will later be tested.

During Level 1 Research, the investment team spends 30 minutes to an hour researching each company in the weekly sprint with the objective of finding a reason to disqualify it from further consideration. We may decide to stop doing work on an investment during this qualification phase for any number of reasons, including excessive leverage, unattractive valuation, unremarkable fundamentals, concerns regarding management quality or corporate governance, insider selling, or a company-specific or industry risk with which we are uncomfortable.

We summarize Level 1 Research for each company in an Investment Checklist that details our findings and whether the idea warrants additional research. At the daily “scrum”, we share our research and work together to identify primary research questions for further study with the goal of better understanding the company’s three or four key value drivers.

4.Test: Thesis Testing (Level 2 Research)

The second phase of the research process involves testing the thesis developed during Level 1 Research through a thorough analysis of the fundamental drivers of the company that incorporates both primary and secondary research. Level 2 Research involves reviewing company filings, transcripts, and investor presentations. We also speak with sell-side analysts, industry experts, other investors, and members of the company’s management team. Finally, we look for alternative sources of information to complement our research process.

We summarize Level 2 Research for each company with an Investment Thesis and a Financial Model, as well as updating the Investment Checklist we created during Level 1 Research.

5.Release: Investment Decision

When we have compiled enough information on a Level 2 Research candidate – sometimes in a matter of hours, sometimes in a matter of weeks – we proceed to the Investment Decision phase. Investment decisions are taken after each team member has had a chance to review the research – and ideally after taking a walk or catching some fresh air to put ourselves in the right frame of mind to make a decision. In the Investment Decision phase we decide between three options:

- Invest

- Place the company on a watch list with a price limit or a time limit

- Return the company to the Idea Backlog for consideration at a later date

Even if we ultimately pass on a name, the resources we have dedicated to researching it is not lost, because we memorialize all of our research for future reference, our knowledge is portable to the next opportunity, and we are better prepared to act quickly if an opportunity arises in the future with respect to the company or the sector.

Review: Sprint Review

At the end of each sprint, the team assesses the sprint’s success in delivering against our objectives and looks for ways to improve the process. In a dynamic environment like the financial markets, no one sprint is identical – but therein lies the strength of an agile method. The objective is to be at once flexible and collaborative with respect to the product and specific and exacting with respect to the process.

Investment Process Tools

In conjunction with our Agile Equity Portfolio Management method, we have built a series of tools used throughout our investment process. These models incorporate both internally generated and third-party data. Many of the tools referenced above – the quantitative screens, the Investment Checklist, and the Financial Model – are proprietary to our research process and designed to fit our particular investment style.

However, there are project management tools that are broadly available to all investment teams or even individual investors who are interested in employing the Agile Equity Portfolio Management method. While there are many products to choose from, we made our lives easy by opting to go with the market leader – Trello.

Scrum Board

This is my physical board located near my trading station. My ‘dashboard on table has 4 columns:

- To Do – trades you intend to open that day,

- In Progress – open positions,

- Testing – potential trades you’re testing,

- Done – fully executed and closed trades.

The cards from the backlog are pinned in their appropriate location on the board and move them as you progress each trade. Physically engaging with the cards better equips you to critically observe your portfolio, allowing you to spot excessive risk exposure quicker and manage this before you suffer losses.

Trello Boards

We use Trello to manage all aspects of the Agile Equity Portfolio Management process and have created three separate boards – Idea Backlog, Weekly Sprint, and Portfolio – to move companies through the process.

Idea Backlog board

Our Idea Backlog board is the central repository for investment ideas for further research. The companies are categorized by sector and region. Anyone from the team is free to add an idea by creating a new card, adding a brief description of the company, the source of the idea, and why it could be interesting.

Weekly Sprint board

The Weekly Sprint board

The Weekly Sprint board is where the team manages the sprint and advances the companies along through the research process, as previously described. At each juncture, the team decides whether an idea is worth pursuing further, whether it should return to the Idea Backlog, or whether it should be discarded.

Portfolio board

The Portfolio board is where the team manages the names that are currently in the portfolio. The investment team continues to add to the body of research as new information becomes available and updates a company’s thesis, financial model, and stock strategy at least every quarter.

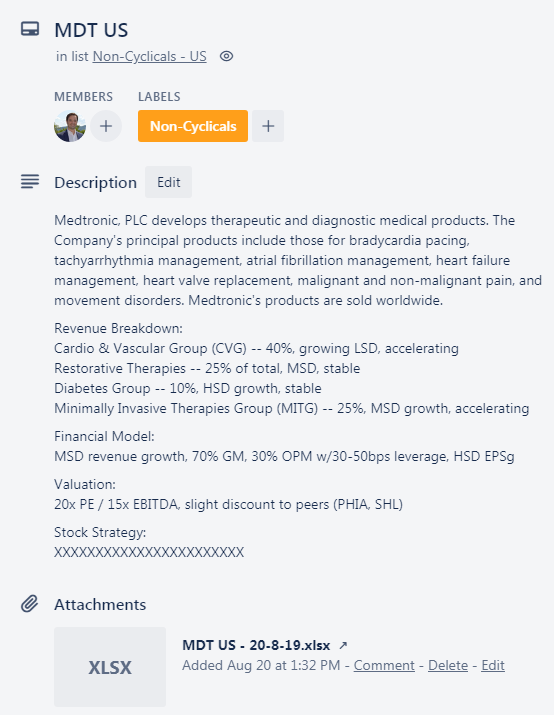

Trello Cards

Each company has its own Trello card to which the research team adds research and commentary over the lifecycle of the investment – from the time it enters the Idea Backlog to the time it exits the portfolio (and returns to the Idea Backlog).

Company card

At any point in time, each company card is meant to contain the body of research the investment team has compiled, making it a “one-stop-shop” for team members to get up to speed on any existing or potential investment.

When a company is added to the Idea Backlog, the card contains basic company information:

- Company description

- Idea source

- Preliminary thesis

During Level 1 Research, the investment team adds:

- Investment Checklist (attached as an Excel file)

- Revenue breakdown

- Key value drivers

- Key research questions

- Stock recommendation

During Level 2 Research, the investment team adds:

- Primary and secondary research notes

- Financial model (attached as an Excel file)

- Investment Thesis

- Updated stock recommendation

- Stock strategy

Finally, once a company is included in the portfolio, the Trello card serves to memorialize the investment team’s ongoing maintenance research and quarterly updates.

Concluding Thoughts

Applying the Agile Equity Portfolio Management methodology has brought clear value to our investment process. Among the many benefits, below are a handful that particularly stand out:

- Idea generation resides in a single location

- Research priorities and status are well defined

- Research process is transparent to all members of the team

- Research content is dynamic, accessible to all, and can even be shared with potential investors as part of due diligence or ongoing manager evaluation

- Documentation provides a record of analysis and decision making and facilitates post-mortem assessments of successful and unsuccessful investments

Leave a Reply