With trading systems the dumbest, simplest, stupidest crap often works nearly as well as complicated things.

I was blown away when I found out that multi-billion dollar hedge funds use pretty simple stuff for their trading systems. Then I later realised that simplicity is the ultimate sophistication.

As my friend (legendary hedge fund trader you should be following) Laurent Bernut is fond of saying “complexity is laziness”.

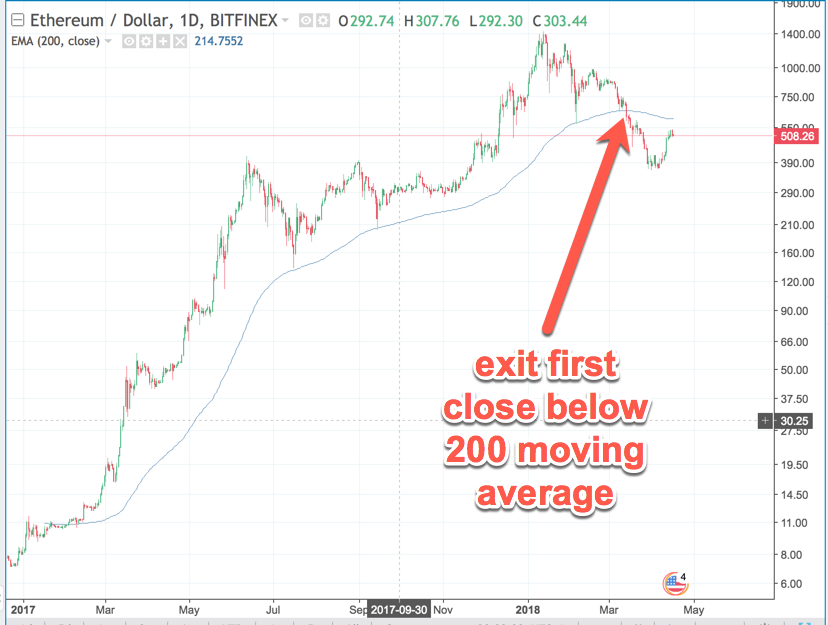

So list the dumbest exit you could possibly come up with. Exit at the 200 SMA would be somewhere near the top of the list, right?

But it turns out that this is not actually a terrible exit for most systems that are trying to catch a trend. (as opposed to catching mean reversion)

But you can improve it SUBSTANTIALLY, and make it actually pro level with a few little tricks.

Trick 1) Exit only on a CLOSE below the moving average, instead of a touch. If that support is going to hold, it should bounce hard off the moving average. Exiting on close saves you many false exits, enough to flip this exit from zero to hero.

Trick 2) We know that trends often end on expanding volatility (blow off tops). Apply a volatility threshold and ONLY switch on your trailing stop when you are at an extreme likely to indicate reversal. My personal go-to is to put a long term bollinger band (100 period, 1 standard deviation) to the ATR indicator. Therefore when price is outside the bollinger (the one on the indicator) you switch your trailing stop on.

This DRASTICALLY improves the performance of this class of trailing stops. If you want a step by step course to show you every single aspect of building high probability trading systems, you can get it right here!

I’ve onboarded all the people who bought the System Building Masterclass at launch, and we are ready to take just a few more people. I’m EXTREMELY happy with what our members have achieved, several are already in the advanced stages of getting their systems ready (which frankly amazes me, it’s way quicker than I’ve ever done it)

I’m more convinced than ever that this course will save you enormous amounts of wasted time and stop you from going down dead ends that can take you months or years. It is, quite simply, the most efficient method of building and testing a trading system ever devised.

CLICK HERE TO GET THE SYSTEM BUILDING MASTERCLASS

It will be available for a few days,

Leave a Reply