Nobody is going to argue with you if you say that buying pullbacks in an uptrend is a good idea.

It’s very solid. But we can improve it with specificity.

What are the BEST pullbacks?

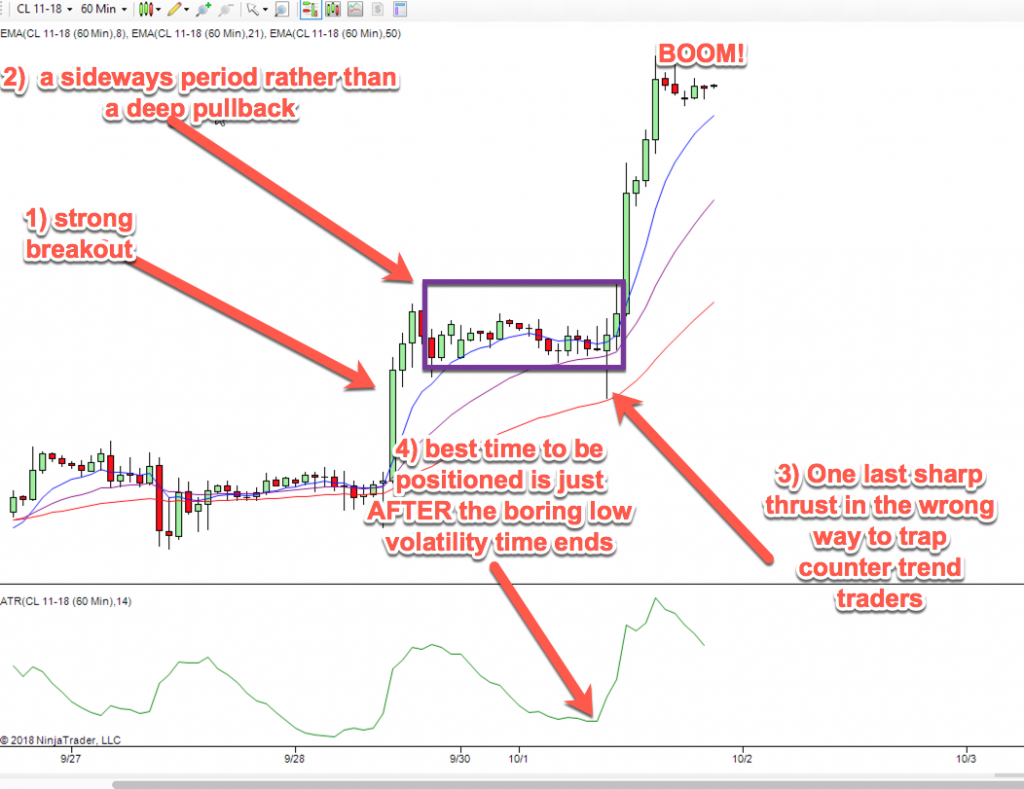

1) The best pullbacks are after a strong breakout

2) The best pullbacks aren’t really pullbacks, just sideways consolidation periods

3) The best pullbacks have a short sharp thrust to run stops of trend followers and trap counter trend traders the wrong-way before taking off

4) The best time to be positioned is just AFTER the market wakes up after a long boring period

Any of that you disagree with? Nope, me either!

Now go through this chart, and you can see that when all the pieces of the puzzle line up, the odds are tilted way in your favour.

This is the biggest secret behind building high probability trading systems.

This trade was from the Failed Breakout System, which is from the System Building Masterclass v2.0. It has a win rate of 65% and expectancy .5, SQN(100) 2.6… an outstanding system by any and every metric.

This is the perfect system for a serious intraday trader trying to compound up a small account. You can trade FX properly with accounts as small as $1000.

If you haven’t signed up yet, the webinar this Thursday October 3rd 7pm EST (Thursday morning in Asia and Australia/NZ) is on the Thor Trend Following System. 2 days time.

It uses this same key concept of specificity in a simpler system that you can execute in just 20 minutes a day.

And if you stay to the end I’ll be giving you a PDF document with the entry technique rules, and offering you a screaming deal on the System Building Masterclass v2.0 for the launch.

Leave a Reply