Why is strategic planning important?

My big picture trading idea is: Make Money, Don’t Lose It! I use eight planning components to build an option trading plan. This is my trade playbook, my master trading plan. My actual trading process, work-flow, math work and ‘thinking algorithms’ are explained separately in blog post: “Thinking like a CEO: Getting into my 8 step Option Trading mindset.“

Just like any business, a trader too needs direction and goals to work toward. Strategic planning offers that guidance. A strategic plan is a roadmap to get to goals, without guidance, there is no way to tell if a trader is on the right track towards goal(s).

My business is to find trading opportunities. I always keep visual theme as shown in left to remind myself of my trading process as finding rare stones/gems from vast sea of rocks and pebbles.

Why am I adding strategic planning process to my trading?

My background is business management and business analysis. I want to use strategic planning processes in which higher management define vision for the future and identify their goals and objectives. I am adopting the same process methodology of sequence in which goals should be realized to reach the stated vision.

My Function-centric strategic plan fits within my trading strategies and provides a granular examination of portfolios. Functional plans focus on rules and processes; such as risk management and trade plan rules compliance, while setting (or allocating) budgets and portfolio allocations.

The best functional plans identify select initiatives ‘aka’ actions and mindset’ that will drive trader’s ambitions ‘aka trading goals’ and commit the capacity (time, capital, budget, talent and technology) necessary to execute successfully. Because my capital, time and talent are limited, I need a smart plan.

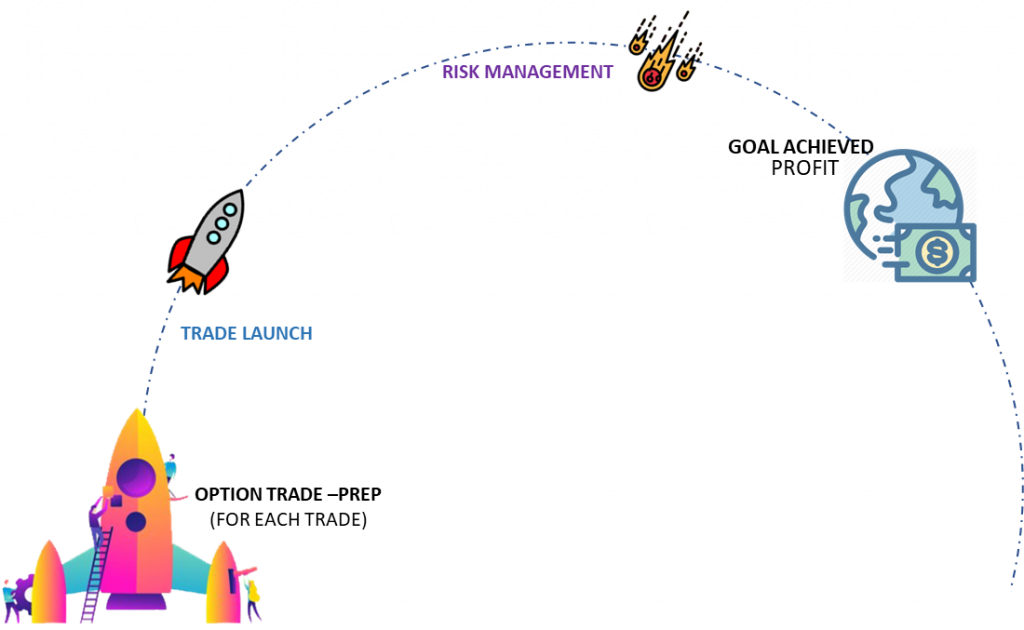

Inspired by NASA’s space project, how serious Nasa scientists are on each launch, I was overwhelmed by the countdown sequence.

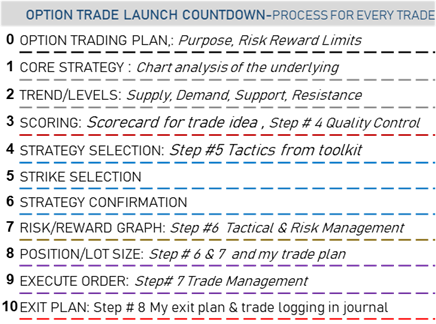

I treat each of my trades nothing short of a rocket launch, and believe it or not, I have also ten checklists for each trade! Let me explain what I mean:

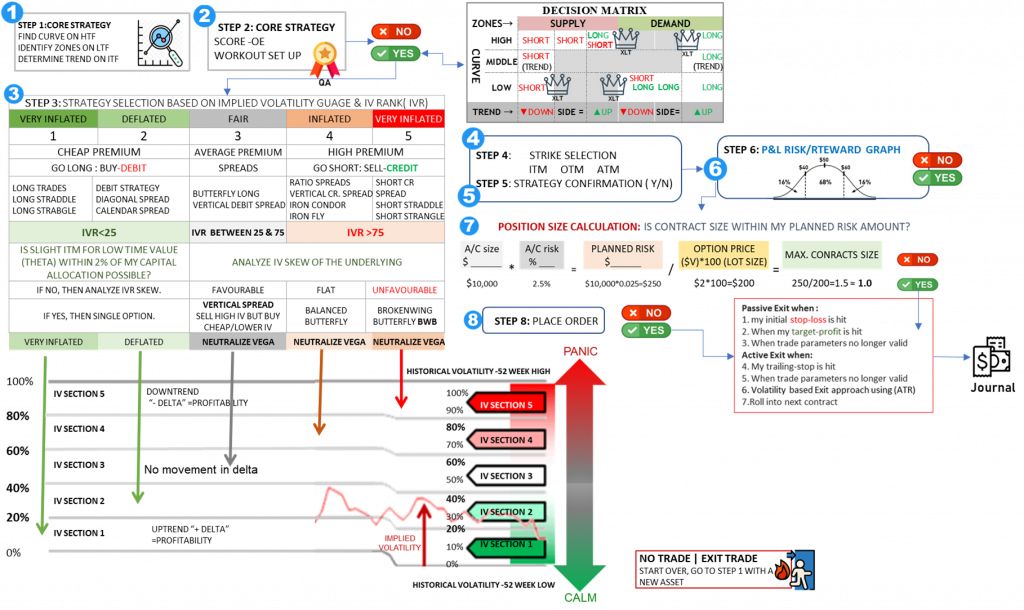

The 8 steps of Trading process of planning:

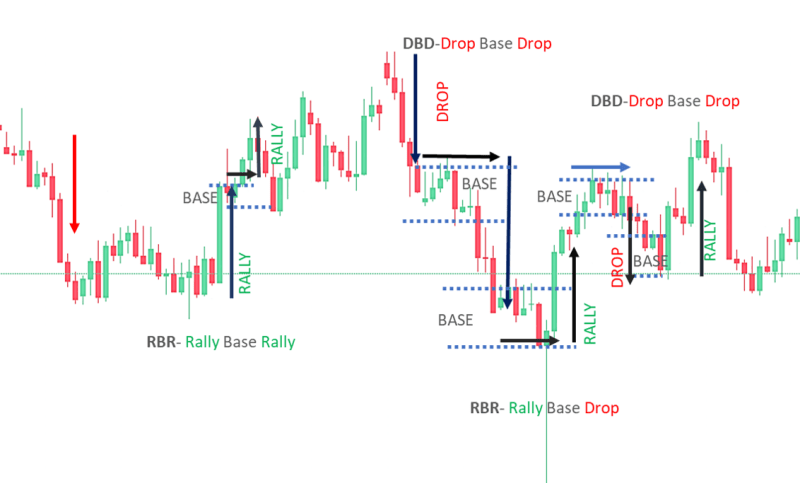

- Analyzing Environment and Situation Analysis:

- Environment Overview: The environmental summary in Higher Time Frame on market structure, intraday structure, price action and other important variables. Putting all these conditions together to get a broad sense of what is going on in the market. With the awareness of the current environment, I can get a significant bias.

- The first step of the ‘trading’ planning process is to get all information relevant to the situation (broad markets, underlaying and economy) to be gathered and analyzed in depth.

- My master trading plan aligns with my high-level logic of forming trade assumptions from “value” and “orientation”.

- SWOT: The strengths, weaknesses, opportunities and threats from (or of) Internal (market) and external (macro and economy and political) environment is analyzed in order to identify strengths and weaknesses (in internal environment) and opportunities and threats (existing in the external environment).

- This step ‘Analyzing Environment and Situation Analysis‘ is translated into step 3 called “watchlist”

- Establishing Objectives or Goals:

- Setting Objectives in the light of the environmental scanning is the second step in the planning process. Objectives or goals are clearly defined in specific terms along with priorities in all the key areas of operations.

- Within my master trading plan this step aligns with my trading objectives, what am I trading. What do I prefer to trade? Before I settle on the market, product or index that I like to trade (GOOG, AAPL, VIX, etc.), I should learn “WHAT DIMENTION” I am trading. The dimensions or concepts I can trade:

- DIRECTIONAL

- Price Direction (up or down) Delta: E.g., selling CSPs trading structure with positive deltas, limit to stocks take long positions only. Delta trading can be hard – as core strategy, technical and fundamental analyses must be consistent especially in the short term.

- “Theta” positions, but many without delta

- NON-DIRECTIONAL: Relative value strategies in the volatility space. Create value buying cheap exposures and selling expensive exposures at the same time, trying to hedge out the main directional market risks that would dominate a traditional asset allocation. Identifying trades is really an important part of the process as they move around all the time over different cycle frequencies.

- Cash-secured put selling are types of opportunities that might last for several years while those strategies are popular

- Volatility (IV vs. HV): Long term basis is IV vs HV. Volatility trading involves making a bet that predicted volatility IV (the amount of movement the market thinks will occur) will differ from realized volatility (what actually happens post prediction). As efficient as the market is, it almost never gets it right, with the exception of major, major products.

- We can bet that the product will overshoot its implied volatility (long vol)

- IV trading: We can bet that the product will undershoot its implied volatility (short volatility)

- Gamma Scalping (time decay): Gamma scalping is long volatility position. It is (buying a straddle with theta) and delta hedging it -Straddles are long gamma; their delta changes favorably: up move – +positive deltas; down move negative deltas. This process forces you put assigned (to go long/buy ULA) when it drops and call assigned (go short/sell) UL when it rallies. Theta here is annoyingly eating your gains. Gamma scalping is great when RV >IV. In this case, gains from gamma will be greater than the theta we have to pay. If IV > future RV, gamma scalping loses money, so sell theta.

- Reverse Gamma Scalping is a short volatility position- Collecting Theta. SPY moves less than implied volatility, which means gamma scalpers lose money overall. Instead of buying a straddle and delta hedging it, sell the straddle. (Risk= buy stock (short put assign when prices are high put call assign) and sell (short call assign short) when it’s low. As the stock rises, we get negative deltas (and have to buy stock to hedge), and when the stock falls, we have positive delta, which we hedge by selling the stock at lower prices. The good thing is that we can collect lots of Theta.

- Correlation and dispersion: Correlation/Relative Strength/Beta (Pairs Trading) COR-3M index

- Mispricing/Difference in pricing (Pure arbitrage)

- Order Flow (HFT)

- M&A/Special Situations (Merger Arb)

- Establishing and or Developing the Planning Premises:

- Premises are factors that affect trading planning. These factors include political factors, market, economy, reports, events, price action, and demand and supply.

- Trade Planning premises develop on the basis of:

- (a) Internal and External Environment

- (b) Forecasting;

- (c) baseline assumptions and

- (d) Events.

- The three techniques for business forecasting (I’m looking for trading equaling):

- #1 Deterministic Techniques

- (a) Latest Information Method

- (b) Programs and Limit Method

- (c) Spotting the Beginning of a Lengthy Process Method

- (d) Diagnosing People’s Expectations Method

- #2 Symptomatic Techniques

- #3 Systematic Techniques

- (a) Intuitive Method

- (b) Econometric Method.

- Determining Alternative Courses of Action:

- There are several alternatives for any plan, try to find trading alternatives for the best outcome. Exam these alternatives against planning premises (assumptions) to reduce the number of alternatives to evaluate for selection.

- Evaluating Alternative Courses:

- In step 4, I made my final selection seeking out alternative courses, my next step is to evaluate the final alternative in the light of objectives and premises. This is the decision-making stage to decide a suitable action selection. Courses of action have to be evaluated in terms of costs and risk involved derivation of profits, availability of resources and long-term trading objectives.

- Selecting the Best Course:

- Now I am at the point of decision-making of plan, after evaluation of alternative course. This stage involves courses of action to follow.

- It is possible that alternative courses to have two or more are advisable, and the managers may decide to follow several courses rather than one which is the best course. Managers have to select the most feasible plan.

- Formulation of Derivative Plans/sub plan:

- In an organization various activities contribute to organizational objectives. After formulating the basic plan, various plans are derived for departments, units, activities, etc. In fact, there are invariable derivative plans to be constructed to support the basic plan. These are developed within the framework of the basic plan and with the help of derivative plan, the basic plan is implemented.

- Derivative plans include objectives, policies, procedures, methods, rules, etc. The final step in the planning process is to select the most feasible plan and develop derivative plans. The plans must include the feedback mechanism. The hierarchy of the plans must be both integrated and flexible to meet the changing environment.

- The derivative plans are required to support the basic and overall plans, because the latter cannot be executed effectively unless they are supported by the derivative or sub-plans. The derivative plans are developed within the framework of the basic overall plan. These planning components are devised to support the overall basic plan of the organization and are generally bound together. These are following:

- Standing Plans – Rules, requirements, checks, Procedures, Methods, and Regulations.

- Single use plans – Programmes, Projects, Budgets.

- Standing plans are formulated to achieve unity and uniformity of efforts in meeting repetitive situations arising at various levels of the enterprise. Single use plans are made for handling non-recurring problems.

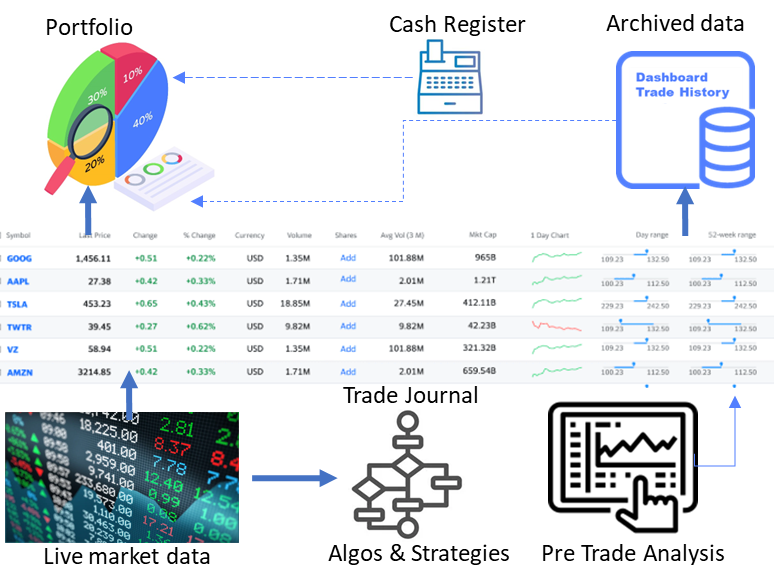

- Feedback, progress, monitoring and feedback loop

Can I Put my master Plan on One Page?

Simple and clear key elements of my strategic master plan: where my trading is, where it is going and how it will get to the future state. (In business terms my trading business is known as functional organization)

Therefore, capture an overview on a single page that communicates how I am adding value today and demonstrates how I plan to impact my trading over the next year. Include a statement of strategy, a before-and-after description of the state of my function, one or two critical assumptions underpinning the strategy, and five to seven initiatives required to meet the functional objectives established to support trading goals.

Drive the plan home

I do this by internalizing and visualizing the objectives and strategy. The one-page strategy template is a helpful tool, as it makes the plan easy to consume, but I still need a deliberate process for my master the plan — and ensuring that key constituencies understood it well.

I must develop a clear and consistent plan on how my priorities are changing and why.

4 Critical Things to Know About Strategic Planning:

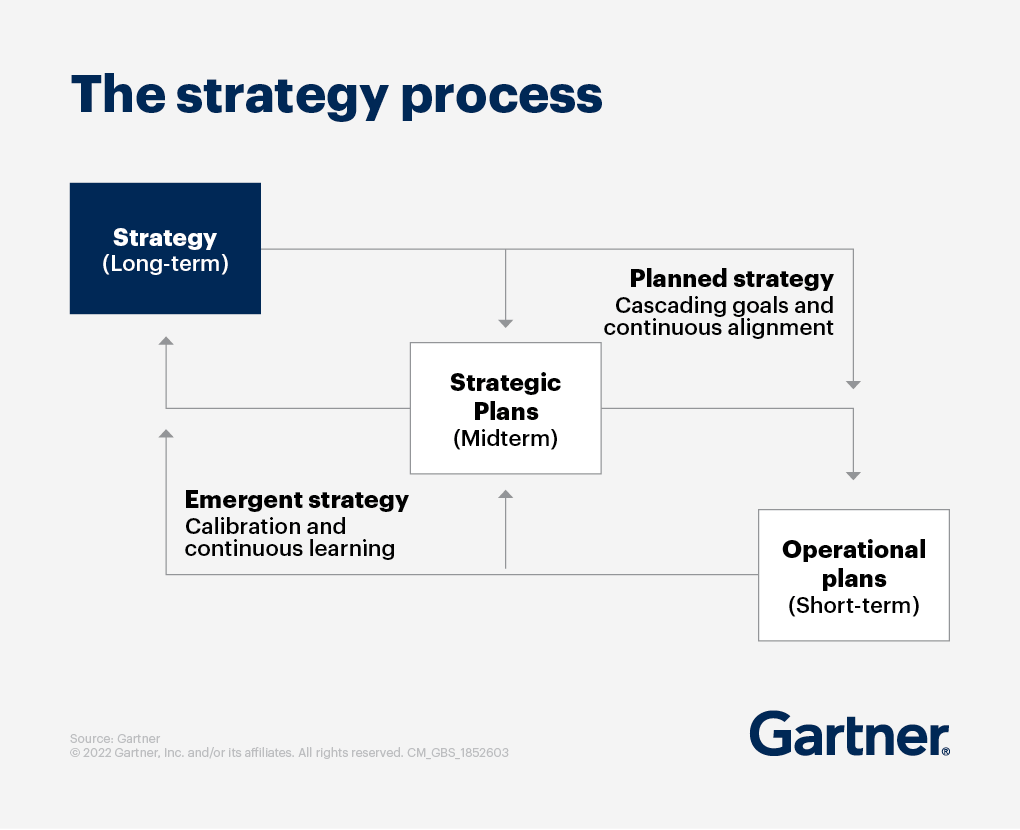

Strategic master plan bridges the gap from overall direction to specific projects and day-to-day trading strategies that ultimately execute the master plan/strategy. Master Plan and trading strategy are different:

My Master trade plan

- Master Strategy Plan defines the long-term direction of my trading.

- Strategic planning defines how I will realize my vision/ mission in the midterm. A clear roadmap of requirements, initiatives, actions and capital allocations are required to execute the strategy and meet trading goals.

- Functional strategic plans document the choices and actions needed for the function to move from the current state to the desired end state, and contribute effectively to the trading model and goals.

- Operational plans deal with the short-term execution of specific Option, Forex, Futures and commodities trade positions, as well as any operational tasks not contained in the strategic plan.

Prepare to respond to change

Once the master strategic plan is adopted, it’s critical to measure progress against the objectives, revisit and monitor the plan to ensure it remains valid, and adapt the strategy as trading conditions change. To do this:

- Monitor triggers to track the effectiveness of the strategic master plan.

- Cancel underperforming specific ‘trade strategies’ (aka projects) quickly.

- Track and validate assumptions periodically.

Lastly, I make sure that I have an agreed-upon action plan for specific steps to take or decisions to make to increase the chances of success when monitoring triggers an alarm

References and links:

What is Strategic Planning? Definition and Steps – TechTarget

17.2 The Planning Process – Principles of Management | OpenStax

Garter -9 Steps to Successful Functional Strategic Planning

Asana – 7 strategic planning models, plus 8 frameworks to help you get started

LeoTheTigers Trading Playbook – Leo the Tiger’s master trade plan

Leave a Reply