This blog is a study group creation plan for OTA trained traders; I have a presentation plan outline for option trading, let call this session/workshop Option trading “study group”.

WHAT: Subject matter is “Options Trading” (26 skills /knowledge areas for option trading listed in here below)

WHY: Objective: Share and learn Methodologies, mindset, and Math (logic/why) of options trading (kind of brain exchange on options trading)

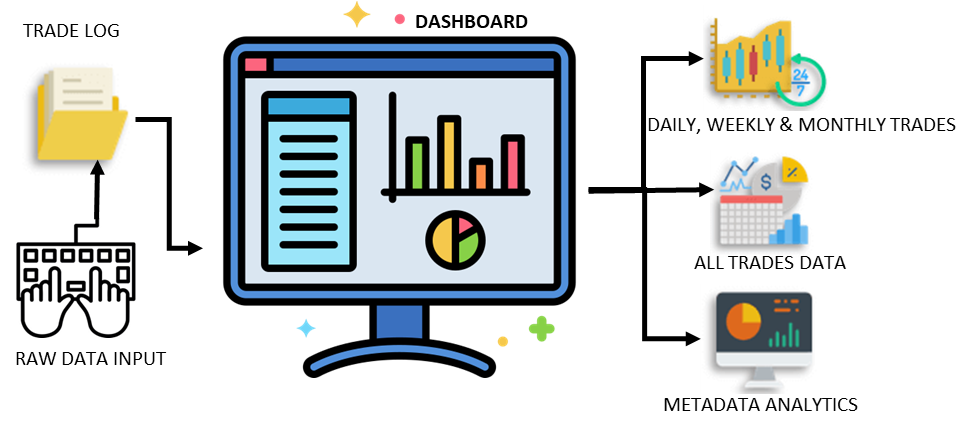

How: Presentation, online sessions, whiteboards, shared documents, examples, resources and trades. To manage content, we will use this blog as a common repository.

WHEN: TBD

WHO: Two categories of dedicated OTA traders here:

- Producers: who will organize, plan, present, volunteer and share “lesson” plan

- Consumers: will not share (state your reason if you are consumer e.g. ‘shy’,) volunteer or participate actively but consume this resource. I welcome them

Professional trading combines traditional left-brain skills of theory, logic, math & analytical thinking with the intuitive, inductive skills of right brain thinking to find the sweet spot with the Greeks.

Mindset, methodology & math

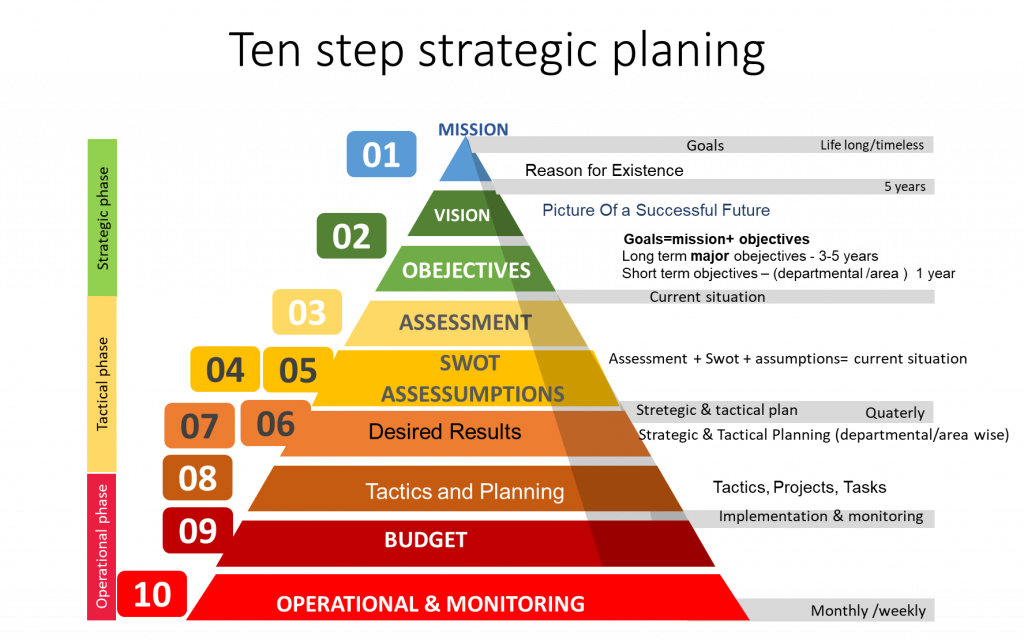

My 8-step options trading “mindset, methodology & math”

Mindset = 8 steps to think like a CEO,

Methodology = 8 steps to construct a trade.

Math= logic, Greeks, baseline and p/L

Skills required

- Remain Top of Mind

- Pich what you know best and explain to others!

- Learn Something New, teach something you know

- This is brain exchange list

- Trading Mentality (This presentation itself) mindset this topic i.e. step # 2 mindset)

- Basic options, futures and trading terms (margin, vocabulary, work flow)

- Account management: →Margin Requirements

- Equity, forex and Future Options (FOP)

- Option Underline: Option Chain analysis on TWS platform: Symbol (strikes, IV, Greeks,)

- Option Position: Option profile analysis on TWS platform: Position (P/L, graph, Probability, Return/risk RRR, BEP, Margin impact, EM scenarios)

- Expiration and Settlement” Future expiration and Option on future, assignment, FUT vs OPT expiry dates

- Expected Move:

- Probabilities

- GREEKS:

- Theta decay (Time Decay) Greeks

- Gamma Risk (Greeks)

- Implied volatility IV (Greeks)

-

- Option Skew

- Buy Versus Sell

- How To Sell

- Equity Versus Futures

- Strategies (toolkit)

- Neutral Strategies (strategies toolkit)

- Direction Versus Neutral Trades (strategies toolkit)

- What Cycle to Trade

- Stop Loss (setup)

- Risk Per Trade (account management, setup, budget)

- Managing Position (set up, post trade management)

- Adjustments (set up)

- Technical Analysis (TLS aka ‘core strategy’)

- Correlations (watchlist, filtering)

- Diversification (portfolio)

- Market Conditions (macro, micro, baseline)

- What To Do After Loss (drawdown, risk, 3R (RRR) rule)

- Trading Checklist /OE

- Portfolio management and deployment

Thanks for supporting this effort. We (you and me) just want to share and grow, embrace best practices.

Leave a Reply