How does trading in a margin account work? ‘Yes’, margin creates opportunities but with additional risk. Let’s check two type of trading accounts:

Cash accounts

A cash account trader must have a sufficient amount of money upfront in his/her cash account to cover the entire risk when entering a trade. The buying power requirement for any trade in a cash account is equal to its maximum risk (pay full purchase price with the money already in cash account).

I have regular margin trading accounts with Interactive Brokers (IBKR).

Margin account

In comparison to a cash account, in margin account I, as trader contribute a portion “margin” of the total transaction’s purchase price, fee, commission and other charges. IBKR is willing to take the risk of borrowing money, and charge interest on the borrowed amount. Margin gives me flexibility and possibilities (aka leverage) to make bigger investments with less capital own money. There is a risk to the trader when trading securities on margin. When a security price loses value quickly then the borrowed money needs to be repaid as well.

General leveraging mechanism of a margin account:

Margin Requirements

Most traders start with Reg T accounts, a type of margin account. In my portfolio I have named it “the works” to distinguish it from my other registered wealth or long-term trading accounts. In the USA brokerages are governed by federal regulations and by the rules of FINRA and the securities exchanges.

Buying stocks on margin

Three main requirements:

- Minimum margin requirement, before I can trade: the bare minimum amount of cash I need to deposit in my margin account before trading on margin. US brokers have set this amount at a minimum of $2,000, and they can set their own minimum funding requirements for a margin account if they want.

- Initial margin requirement, amount I can borrow: Portion of the total purchase price (in dollars or as a percentage), I must pay with own cash (or cover with margin-eligible or marginable securities) to open the position. How much can I borrow to make a new trade? I am allowed to borrow up to 50% of an investment’s value.

- Maintenance margin requirement (MMR), amount I need after the trade):

- Minimum equity value (value of cash + market value of securities – liabilities) that I must maintain in my margin account as collateral for the loan. MMR activates after I have traded the position (stocks or underlines are purchased), and up until the position is closed.

- maintenance margin activates after the position has been established. Remember, the initial margin requirement was applied before the trade.

- The maintenance margin requirement (MMR) can be calculated for one single position or calculated at account level for the different positions together.

- The MMR for a long stock position (purchased stock) expressed in $ dollars, is equal to the total actual value of the securities multiplied by the margin requirement (%).

- To calculate the level of margin of account, divide the ‘account equity’ by the ‘market value’ of the securities.

- My minimum equity must not fall below 25% of the current market value of the securities (after the initial margin of 50% for opening a position, the margin percentage can drop but has to remain above the minimum 25% level).

- MMR protects IBKR from the risk, when things go bad. If my account’s margin falls under the set maintenance margin requirement, the IBKR gives me the trader a margin call, to deposit of more money or securities in the account is required. Or that investments held in the account need to be liquidated (sold at market price) to maintain the minimum account value.

What is equity? The equity is the real value owned by me in my margin account. Mathematically my equity is = ‘total cash value’ + ‘value of the securities’ – ‘liabilities (loans).

Net Liquidating Value (NLV): account equals total cash value + stock value + securities options value + bond value + fund value

The following example shows how margin creates leverage, and depending on the direction of the price move, can potentially double my gains or losses. This is what leverage in margin does.

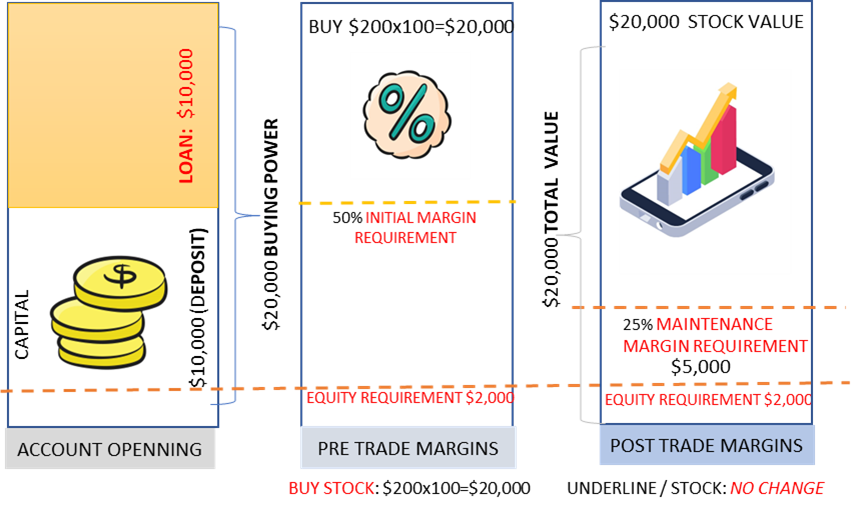

Example: I have a margin account and have deposited $10,000. For trading stocks in a margin account IBKR allows me to open new positions at a 50% margin. For each trade I open, I must have at least 50%, equal to the minimum initial amount. My buying power with the $10,000 deposit and the loan amount of $10,000 works out to be $20,000. My account’s structure:

- Cash: $10,000

- Cash Balance: Cash – Loans = $10,000.00 – $0.00 = $10,000.00

- Buying Power: $20,000.00

- Stock value: $0

- Equity: $10,000 cash + $0 stock – $0 margin loan = $10,000.00

IBKR allowed me to lend me 100% (i.e. $10,000) against my contribution to trade. With this borrowing my available cash is now $20,000. I am planning to add one long position with a stock of $200×100 shares =$20,000 (assuming fee, taxes and commission is included in transaction). With my buy order IBKR will take out the available $10,000 in cash from my margin account and loan me $10,000 towards my trade execution. IBKR has pre condition for loan, and that is, “I must have the 50% initial margin requirement ($10,000) for new trade”.

My margin calculations = (‘my portion’/’total purchase cost’) = ($10,000/$20,000) = 50%, that I must fulfil, then IBKS will let execute trade.

After the trade, the maintenance margin requirement is activated, in my case it is set 25%. My margin at account level = ‘account equity’ / ‘stocks value’ must be above 25%. My account’s structure after opening a new position:

- Cash: $0

- Margin Loan: $10,000

- Cash Balance: – $10,000 (cash – ‘margin loans’)

- Shares purchased: $200×100=$20,000

- Equity: $0 cash + $20,000 stocks – $10,000 margin loan = $10,000

- MMR: ‘account equity’/ ‘stock value’ at 25%. Account equity at $10,000 and stock value of $20,000, the account margin at 50% is above the minimum level of 25%.

- My stock will be kept as collateral against the loan until the loan of $10,000 is paid or extra cash or securities are deposited. IBKR will charge interest on the loan.

IBKR limits its own risk by keeping the securities and cash held in my margin account as collateral for the loan amount. IBKR ensures that my margin account has enough equity (=equity of the account above a minimum level) or value to pay back the loan, at any given time.

After purchase, my position is opened, and with share price$200 (no change in price yet), the MMR is $20,000 x 0.25 = $5,000. I need to have more than $5,000 of equity to meet this MMR.

Maintenance margin requirement is based on the current market value of the securities (stocks), and not on the purchase price. Fluctuating share price impact portfolio and margins of positions with underline prices going up and down as following scenarios:

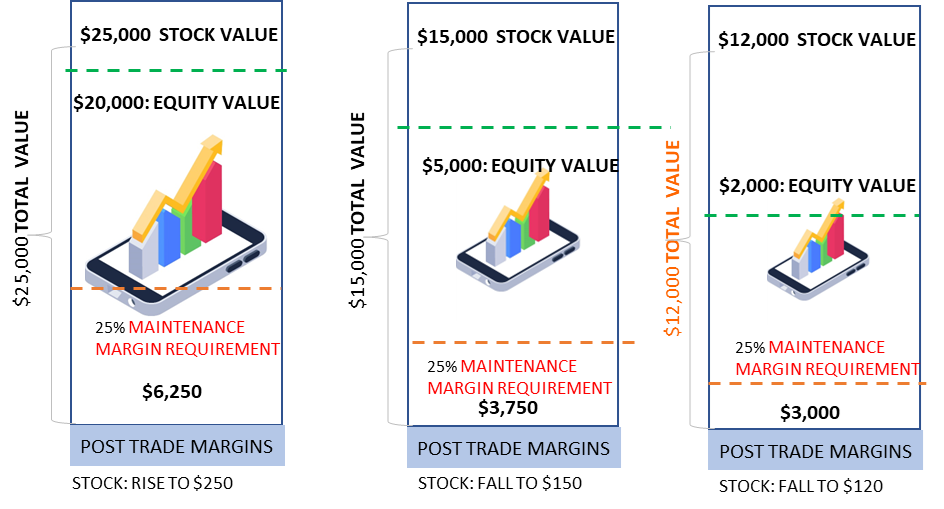

- No change in stock price

- margin remains at 50%

Scenario ‘portfolio increases in value‘: The stock rises by $25 to $250, my profit target is met, and I closed the position by collecting $250×100=$25,000. The loan of $10.000 is paid and my account now has $15,000($25,000- $10,000=$15,000). I invested $10,000(and borrowed $10,000), to make net profit of $5,000 on my $10,000 initial capital investment. My ROI is $5,000/$10,000=50%. Without margin, only using my own cash of $10,000, I could buy $200×50 shares and after closing that position my proceeds would work out to be total of $250×50= $12,500. This is a net profit of $12,500-$10,000= $2,500, so $2,500/$10,000 =25% ROI on $10,000.

- stock raises to $250.00

- Stock position value = 100 x $250.00 = $25,000

- Equity = $0 cash + $25,000 stock value – $10,000 margin loan = $15,000

- MMR = $25,000 X 25% = $6,250

- Margin = $15,000/$25,000 = 60% (above 25%)

Scenario ‘portfolio decreases in value’: The stock drops by $25 to $150, my stop loss is triggered my position is closed by collecting $150×100=$15,000. The loan of $10.000 is paid and my account now has $5,000($15,000- $10,000=$5,000). This means my net loss is $5,000/10,000=50%. On initial investment of $10,000 a ROI of -50%. Without margin, only using my own cash of $10,000, I could buy $200×50 shares and after closing that position my proceeds would work out to be total of $150×50= $7,500. This is a net loss of $2,500 on a $10,000 investment. A ROI of -25%.

- Stock drops to $150.00

- Stock position value = 100 x $150.00 = $15,000

- Equity =$0 cash + $15,000 stock value – $10,000 margin loan = $5,000

- MMR = $15,000 X 25% = $3,750

- Margin =$5,000/$15,000 = 33.33% (above 25%)

- Stock drops to $120.00

- Stock position value = 100 x $120 = $12,000

- Equity = $0 cash + $12,000 stock value – $10,000 margin loan = $2,000

- MMR = $12,000 X 0,25 = $3,000

- Margin = $2,000/$10,000) = 20% (below 25%)

Key points to remember about margins: Initial margin requirement determines how much Ican borrow to open the position and the maintenance margin requirement (MMR) determines how much dollar value you need to keep in my account as collateral after the position has been established. The maintenance margin requirement fluctuates with market conditions.

Leave a Reply