It is said that 90% of traders lose money in markets, if you are reading this, it follows that you want to with 10% profit makers. This guide encapsulates my personal learning path towards professional trading.

Step 1: Getting Started

- Planning:

- Define your investment goals: Before you begin investing, define and write down your objectives. This will help you to develop your investment strategy.

- Start with your current situation. (Example)Are you retired? (Yes/No) Do you have the ‘free time’ to learn? (Yes/No) What is your typical daily routine? (700 to 1800 hrs work, Monday thru Friday)

How much time per week do you currently spend looking at or managing your investments? (4 hours per week) What is the ideal time of day available for you to dedicate towards trading and investing? (7:00am to 8:00am) What is your experience level in the financial markets? (I have some trading and investing experience) I have invested or traded in the following markets / investment vehicles: (Mutual Funds, Stocks, TFSA) Please describe your decision-making process when evaluating an investment opportunity. (Value and growth investor, buy low sell high or sell high buy low) - Your specific financial goal (examples)Retirement funds

Generate extra monthly income, my initial monthly total income goal $5,000.00), My current monthly fixed expenses are ($3,000.00) I am able to dedicate ($1,000.00) to an initial trading account. - Open a trading account: You can open a stock trading account with small sum of $1,000. Do your research on commissions and others aspects of trading like: -Minimum deposit,

-Leverage,

-Loads of instruments to trade (Forex, commodities, indices)

-No platform fees,

-Many ways to fund your account (Wire, Direct deposit and transfers),

-Easy to use platforms,

-Lowest possible commissions on trades, - Consider your timeline:

| Trading Style | Time Frame | Holding Period |

| Position Trading | Long Term | Months to years |

| Swing Trading | Short Term | Days to weeks |

| Day Trading | Short term | Day only |

Breakouts

Breakouts are one of the most common techniques used in the market to trade. They consist of identifying a key price level and then buying or selling as the price breaks that pre-determined level. The expectation is that if the price has enough force to break the level, then it will continue to move in that direction.

Step 2: Trading Strategies

- Breakouts: Breakouts are identified as (a) a key price level and then (b) buying or selling as the price breaks that pre-determined level. You have to develop this skill to understand an underlying concept to see if “price has enough force to break the level, and continue to move in that direction (upwards or downwards).

- Retracements (Pullbacks): When you are identifying direction for the price to move in, and price will continue moving in. The underlying concept is that “after each move in the expected direction, the price temporarily reverses” as traders get out of their positions and take their profits and new traders (novice) attempt to trade in the opposite direction. These pull backs offer better price to enter trade in the original direction, before the continuation of the move.

- Reversals: There are times the when markets tend to ‘range’ or move sideways with no clear direction. Then at key price levels ‘bounce is expected’ for a small opportunity.

- Momentum: Momentum is force and cause continuation of the move(trend). Do not look for price to pull back or break out from any specific price, but merely to start moving more or less in the direction of the prevailing trend.

- Position trading: Position trading big daddy of momentum strategy, objective is to get in the market when the price makes a move. Traders build a position (i.e. holding a stock for more than a day or more).

Step 3: Learning and Study to Improving Your Chances of Success

Ten Commandments

- Always use “Protective Stop Loss” for every trade.

- Follow your ‘three Ps of trading’, Rules and system, don’t let your emotions do the trading.

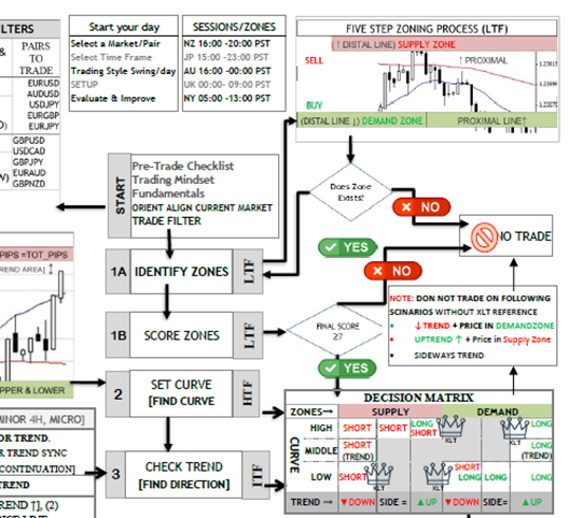

3 Ps OF PROFESSIONAL TRADING: Process | Probability | Profit- (A)Start with charts for:1) Broad markets 2) Curve, Trend & Zones

- (B) Search for stocks with momentum, liquidity and watch list norms.

- (C) Use your charts to define your trade parameters. Wait for higher probability trades. Use Odds Enhancers or other criteria to qualify your trades.

- Rules to qualify a trade:

- Set a minimum score should be (75%) probability.

- Strong directional trade.

- What is overall trend? Is trend likely to continue, poised or reverse? Return must be based on dollars at risk!

- Plan predefined risk and reward for asymmetric trade parameters. If your Risk to Rewards ratio (RRR) is 1 to 3, you only need 25% winning trades to be profitable! On the other hand, if profit ration to risk is one to one, then in this case you should have all of you trades winning, and that is insanely impossible! Risk/Reward Ratio Win % Needed to be Profitable 1:1100 %1:250 %1:325 %

- Don’t trade where disruptions are possible.

- Do not over-trade, if three losers in a row STOP Trading!

- Know the difference between gambling and trading.

- Stick to your daily loss limit, that is 2% of capital.

- Use small position sizes to begin with.

- Trade your plan only, trade what you know.

- Do not add to losing trades. Cut your losses.

- Learn how not to lose money.

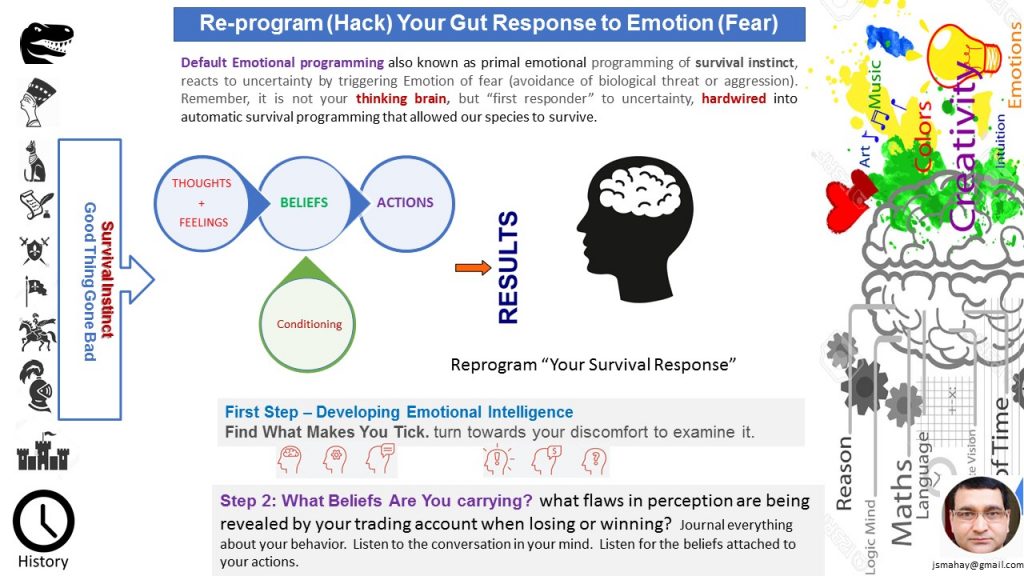

Step 4: Trading Psychology – The Secret of Professional Traders

Do not trade with emotion: ‘easier said than done’! Understand how our brains work. We are still carrying with us some defunct and very old instincts (automatic hardwired behaviors) force us to react to greed or fear.

Step 5: Analyzing Your trades and Adjusting Your Strategies and Styles

Step 6: Bankroll Management

Protect your account with money management, and make rule-based trading to grow your account.

Leave a Reply